16.12.2024

Commentary by Artur Popko, President of the Management Board of Budimex SA, on selected financial data from the consolidated financial statements of the Budimex Group for 2024

The year 2024 is a time of intensive activities for the Budimex Group, which brought us a record order book and a stable position as the leader of the construction market in Poland. A record order backlog and improved operating profitability in a difficult period on the market make us assess 2024 very well. We are optimistic about the coming years.

Thanks to a diversified order portfolio, the Budimex Group has maintained stability, which will allow it to continue its diversification-based course in the coming year . Successes in acquiring key projects will allow us to engage in further implementation of strategic infrastructure investments: rail, road, hydrotechnical and energy, as well as to maintain a good and healthy portfolio in the field of cubature investments. In the 4th quarter of 2024, the Budimex Group signed new contracts worth over PLN 4.3 billion, and in the whole of 2024, despite the difficult market situation, it contracted investments for a record value of PLN 12.5 billion. The value of contracts in the so-called. of waiting rooms is nearly PLN 7 billion.

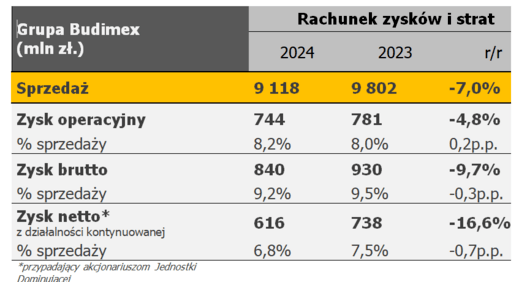

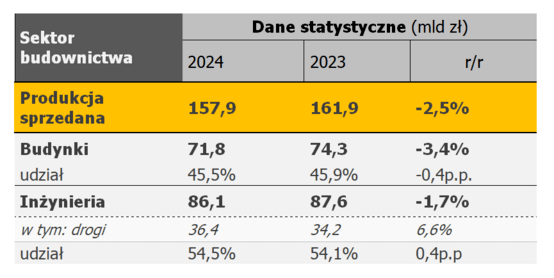

Construction and assembly production in 2024 (current prices) fell by 2.5% year-on-year from PLN 161.9 billion to PLN 157.9 billion. In the buildings segment, sold production decreased by 3.4%, while in the infrastructure area a decrease of 1.7% was recorded.

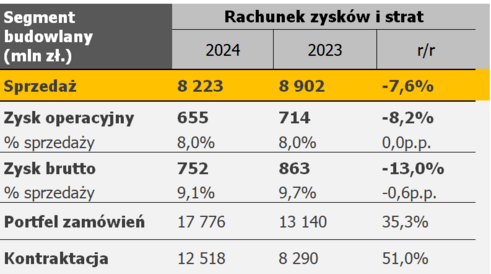

Sales of the construction segment of the Budimex Group in 2024 amounted to PLN 8,223 million (-7.6% y/y), maintaining a stable operating profitability of 8% with a slight decrease in gross profit margin (from 9.7% in 2023 to 9.1% in 2024).

The decline in sales was mainly due to the investment cycle of the largest contracting authorities, in particular in the railway area. In addition, several important contracts in the area of cubature construction, which last year had a significant share in sales revenues, were completed.

The operating margin of the construction segment was 8.0% and was equal to the level achieved in the financial year 2023. The stabilization recorded was due to several factors. On the one hand, we observed continued price stabilization and satisfactory availability of construction materials and subcontractors’ services. On the other hand, we place constant emphasis on cost control and optimization of business processes at every level of the organization.

The gross margin of the construction segment in the period in question amounted to 9.1% and decreased slightly compared to the corresponding period of the previous year, when it amounted to 9.7%. The decrease in gross profit profitability was directly influenced by lower financial income and lower return on deposits offered by banks, which was caused by the reduction in interest rates started in the third quarter of 2023.

Throughout 2024, we acquired contracts worth over PLN 12.5 billion. The Budimex Group’s order book at the end of 2024 amounted to PLN 17.8 billion, of which over PLN 1 billion was attributable to contracts and orders carried out outside the country. The high value of the order book secures the Group’s work front until the end of 2025, as well as for most of 2026, partially moving to 2027. Intensive work on the acquisition of new projects has resulted in the value of projects awaiting signing, and those where the offer of Budimex or Group companies was rated the highest (as of 31 December) at nearly PLN 7 billion (of which nearly PLN 5 billion relates to the RailBaltica contact in Latvia). In the perspective of the coming quarters, this will allow for a balanced and responsible approach to bidding in upcoming tenders.

The Budimex Group ended 2024 with a net cash position of nearly PLN 3.1 billion. In June 2024, in order to comply with the assumptions of the adopted dividend policy, Budimex SA paid a dividend from the profit generated for 2023 in the amount of PLN 749.6 million and retained earnings from previous years in the amount of PLN 161.6 million, which gives a total of PLN 35.69 per share.

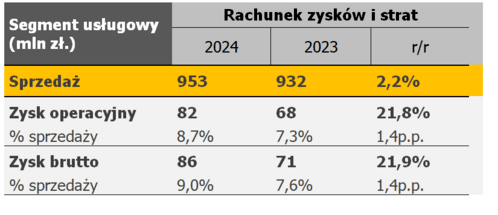

The FBSerwis Group recorded the highest level of sales revenues in history, recording a y/y increase of PLN 34 million while maintaining good profitability.

The FBSerwis Group, which is a key asset in the services segment (the results of the service part also include the activities of companies from the RES area, Budimex Mobility and Budimex Parking Wrocław) achieved a record level of sales revenues of PLN 937 million, recording an increase of 3.8% compared to the same period of the previous year. The FBSerwis Group generated an operating profit of PLN 94 million (compared to PLN 81 million for 2023), while recording an increase in profitability from 8.9% to 10.0%. The gross profit of the FBSerwis Group for 2024 reached a record level of just over PLN 100 million with the highest net cash position in history of PLN 241 million, of which cash accounted for PLN 252 million.

We are consistently developing our RES business by expanding our portfolio of assets in the form of wind farms and photovoltaic farms. The “Magnolia” project from September 2023. produces green energy, which we sell to one of the listed companies through a PPA (Power Purchase Agreement). We also purchased one ready-to-build project – “Azalia” with a capacity of 60 MW and in May 2024 we started construction work. Our goal is to produce the first green kilowatt hour from this investment in the third quarter of 2025. BxF Energia is in the process of implementing projects with a potential future capacity of over 1.7 GW. More than half of this value is wind and hybrid (PV + wind) projects.

In 2024, Mostostal Kraków S.A. achieved a financial result of PLN 42.3 million, which confirms the stability and dynamic development of the company. The company continued its activities in key industrial sectors, implementing projects related to the cement industry, chemical industry, bridge infrastructure, as well as the construction of public facilities. Thanks to its experience and specialist knowledge, the company effectively implemented the entrusted investments, contributing to the development of national and international infrastructure.

Last year, the company also carried out projects on foreign markets, strengthening its presence in Europe. Among the most important projects were works on the modernization of the Aviicii Arena in Stockholm and the start of the construction of a bridge over the Nemunas River in Kaunas, Lithuania. In the area of national infrastructure, Mostostal Kraków has started the construction of a multimodal hub in Pyrzowice, which is of key importance for the development of transport and logistics in the region. In addition, 2024 was a breakthrough year for Mostostal Kraków in terms of its involvement in the development of nuclear energy in Poland – the company has started the qualification process for the construction of the first nuclear power plant in the country. This strategic step opens up new opportunities for the company in the energy sector and is an important part of its long-term growth strategy.

On the German market, Mostostal Kraków achieved a turnover of PLN 251 million, of which PLN 203 million came from activities related to the prefabrication of reinforced concrete elements and steel structures at over 40 factories in Germany. In addition, PLN 48 million was generated in revenues from assembly activities carried out under key contracts. The most important projects on the German market in 2024 included the delivery and installation of the steel structure and roofing of the Duisburg railway station, as well as the delivery and assembly of the steel structure as part of the construction of a new unit in ZRE Hamburg. The activity of Mostostal Kraków on the German market confirms continuous development and the ability to implement large, international projects, strengthening its position on the market.

Market outlook

We are entering 2025 with a historic order backlog of PLN 17.8 billion. Record contracting and, consequently, a significant increase in the order book is also one of the key achievements of our Group in the past 2024. It is invariably a healthy portfolio, about 2/3 of the portfolio are contracts signed last year, valued at current market prices and most often containing indexation clauses. The current order book offers the prospect of a stable margin and secures the work front for 2025/2026. In addition, a significant number of orders are “design and build” contracts with completion dates of 2027-2028, which gives us the foundation for our business for the next few years.

On the local market, we are constantly observing an aggressive fight for orders, especially in the road and rail areas. This is due to the fact that the current potential of general contractors in Poland is much higher than the scale of investments commissioned by the largest contracting authorities in recent years. An unstable investment cycle is also an important factor influencing this situation, especially in the railway segment, which relies heavily on EU funds. Therefore, the industry points to the need to ensure stable financing of railways, also from national funds, or to look for PPP solutions, as is implemented in neighboring countries m.in. in the Czech Republic.

We are also observing strong competition from foreign entities, but we can see the first positive signals in this regard, including in particular the judgment of the Court of Justice of the European Union regarding the participation of non-EU companies in tenders, which can provide everyone with equal opportunities to compete for orders.

The last few quarters in the Budimex Group have been a time of preparing the organisation for growth in the coming years and the implementation of a record order book. We are adapting our implementation structures and at the same time strengthening the area of production support. Wherever possible, we introduce solutions based on digitization and automation of processes, also with the use of artificial intelligence. Our activities are aimed at preparing the entire organization for sustainable growth, taking into account the ambitious goals we have set in the ESG strategy for 2023-2026.

We are consistently developing the industrial and energy area, we have also built structures and are preparing the organization to carry out orders for the construction of a nuclear power plant. In the cubature part, we are strengthening our competences in the military segment.

For several years, we have been one of the certified partners of military investments in Poland. In 2025, PLN 186.6 billion, or 4.7 per cent of GDP, is to be allocated to defence. PKB. These measures are taken into account m.in. in railway or road construction. We expect that a significant part of these budgets will be used to implement new construction projects. We hope to obtain further military contracts – both infrastructural and related to accompanying architecture.

We have also created organizational structures for the purpose of acquiring and implementing financing and building contracts, including in particular in the data center segment. Last year, we also returned to the residential market, with the first development project in Poznań being implemented in the joint-venture formula.

In the coming quarters, the priority will be the responsible execution of the record order book and scaling of businesses on foreign markets. In the coming year, we expect the trend of increasing the share of foreign markets in the Group’s revenues to continue. Over the last 2 years, we have built structures on the markets, we have the right people, equipment, capital and experience to carry out such complex contracts. Combined with a record-breaking portfolio on the local market, this gives us the opportunity to strengthen the position of the Budimex Group as a leading construction company in Central and Eastern Europe.

Social responsibility and market confidence

Budimex’s return to the WIG-20 index after 20 years is proof in March 2024 that the strategy we adopted has been positively received by the market. Again, entering the group of the largest companies listed on the Warsaw Stock Exchange is also the result of investor confidence, which we have been working for continuously for nearly 25 years of the company’s presence on the Warsaw Stock Exchange.

We understand the role of business today and are determined to act responsibly and sustainably as a company. Since 2023, we have been implementing the ESG Strategy. In our activities, we place equal emphasis on all three areas. In line with our environmental goals, in 2024 we achieved recycling and recovery of soil and soil on our investments at the level of 73%. In addition, nearly 90 percent. of the electricity we obtain from the market already comes from renewable sources.

When it comes to social responsibility, m.in. investments in building the competences of our employees to provide them with a clear and stable development path, but also to be well prepared for market requirements. We run a number of programs, such as the Manager or Engineer Academy – focused on professional skills, but also the Super Leader or Master Synergies projects developing soft skills, which are very important today. On an annual basis, we spend over PLN 8 million for this purpose. Being aware of the challenge posed by the shortage of employees in our industry today, we actively work to support the technical education system. In the last two years, we have signed over 50 contracts with technical schools and universities. In 2024, we also carried out further editions of our flagship CSR campaigns. We have opened m.in. new “Parent Zones”. Budimex for Children” – in Bielsko-Biała, Poznań and Bratislava. At the end of December, we handed over the keys to the third “House from the Heart”, which this time we built for our heroine – Mrs. Teresa from Wołomin. We also joined in helping the flood victims, to whom we provided in-kind support. Our equipment and contract teams cleaned up the flooded areas, and today they are taking part in their reconstruction.

For us, the foundation of corporate responsibility is credibility, honesty and transparency of cooperation within our teams and with partners. Last year, we conducted a number of internal campaigns in the field of ethics, conflict of interest management and counteracting corruption risks. Nearly 1500 employees also took part in compliance training.

In 2024, our efforts to strengthen the company’s potential and develop the business were appreciated by the market. Przyznano nam m.in. the Bulls and Bears award of the Parkiet stock exchange newspaper, Forbes Diamond, as well as the title of Construction Brand of the Year and Company of the Year 2024 during the XXXIII Economic Forum in Karpacz. In addition, nine of our projects received the so-called. Construction Oscars awarded by the Polish Association of Construction Engineers and Technicians. The awarded projects include a sports hall for the Central Sports Centre in Wałcz, the Polish Theatre in Szczecin, the Integrated Communication Centre in Lublin, a sports and entertainment hall in Gorzów Wielkopolski, the S-61 expressway Augustów bypass, a tram depot in Olsztyn, a bridge over the Regalica River, the Museum of Polish History, as well as the railway junction “LOT C, section Vistula Bridge – Czechowice-Dziedzice – Zabrzeg”, which was awarded a special prize. In addition, two contracts we have completed have been awarded in foreign competitions. The Polish History Museum has received the ULI Global Award for Excellence 2024 for functionality and user experience. In turn, the design of the Lublin Metropolitan Station won the main distinction in the WAF 2024 architectural competition. It is a great satisfaction to be able to implement projects that are also noticed by the international community.