28.10.2024

Commentary by Artur Popko, President of the Management Board of Budimex SA, on the financial data of the Budimex Group for the three quarters of 2024

A record order backlog, improved profitability and higher operating profit make us assess the end of the three quarters of 2024 very well. The Group’s stable condition allows us to look to the future with confidence.

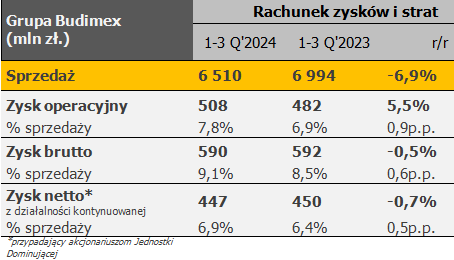

We improved profitability at every level of the income statement, with operating profitability reaching 7% in the first quarter, and 7.6% and 8.6% respectively in the second and third quarters.

The gross profit of the Budimex Group amounted to PLN 590 million with a profitability of 9.1% compared to 8.5% for the nine months of the previous year. As in the corresponding period of the previous year, profitability at the level of gross profit was supported by financing activities, which consisted mainly of interest earned on cash held. The decrease in sales revenues is caused by delayed administrative procedures for some contracts implemented in the “design and build” formula. Next year, due to the historical order backlog, we expect a change in trend and an increase in revenues.

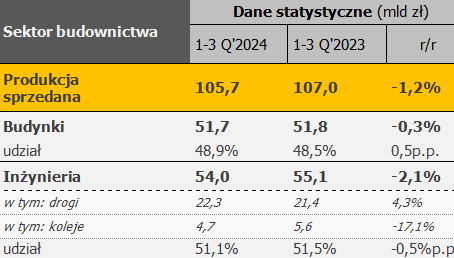

Construction and assembly production in the third quarter of 2024 (current prices) fell by 1.2% year-on-year from PLN 107 billion to PLN 105.7 billion. In the buildings segment, sold production decreased by 0.3%, while in the infrastructure area a decrease of 2.1% was recorded.

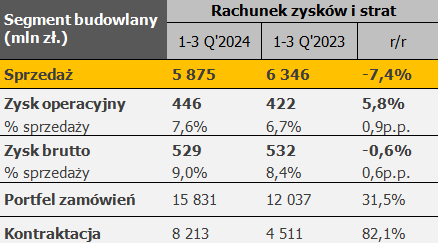

Sales of the construction segment of the Budimex Group in the first three quarters of 2024 amounted to PLN 5,875 million (-7.4% y/y), while recording an increase in both operating profitability (from 6.7% to 7.6%) and gross profitability (from 8.4% to 9.0%).

The scale of sales revenues generated in the first nine months of 2024 in the construction segment was lower than in the corresponding period of the previous year. The decline in sales was mainly due to the investment cycle of the largest contracting authorities, in particular in the railway area. In addition, several important contracts in the area of cubature construction, which last year had a significant share in sales revenues, were completed.

The operating margin of the construction segment amounted to 7.6% and was higher compared to the corresponding period of the previous year, when it amounted to 6.7%. The recorded increase was due to several factors. On the one hand, we are observing a continuing trend of further price stabilization and greater availability of construction materials and subcontractors’ services. On the other hand, we are constantly working on cost control and process efficiency at every level of the organization. The increase in profitability on an annual basis is also due to the end effect

and settlement of several large and financially difficult contracts last year, which improved the average profitability of the entire order portfolio.

The gross profitability of the construction segment in the period under discussion amounted to 9.0% and improved compared to the corresponding period of the previous year, when it amounted to 8.4%. During the first three quarters of 2024, in addition to an increase in profitability at the operating level, profitability at the level of gross profit was supported by a positive result generated on financing activities due to interest on deposits.

In the first three quarters of 2024, we signed contracts worth PLN 8.2 billion. The Budimex Group’s order book at the end of September 2024 amounted to PLN 15.8 billion, of which over PLN 1 billion was attributable to construction contracts signed outside Polish. The high value of the order book secures the Group’s work front until the end of 2025. Intensive work on the acquisition of new projects has resulted in the value of projects awaiting signing, and those where the offer of Budimex or the Group companies was rated the highest (as of 30 September) to over PLN 8 billion. In the perspective of the coming quarters, this should translate into maintaining a high value of the order book and will allow for responsible bidding in upcoming tenders.

The Budimex Group ended the first three quarters of 2024 with a net cash position of over PLN 2.3 billion. Fulfilling the assumptions of the adopted dividend policy. In June 2024, Budimex SA paid a dividend from the profit generated for 2023 in the amount of PLN 749.6 million and retained earnings from previous years in the amount of PLN 161.6 million, which gives a total of PLN 35.69 per share.

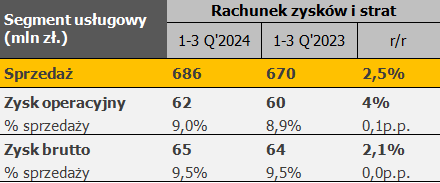

After three quarters, the FBSerwis Group recorded a year-on-year increase in sales revenues by PLN 9.4 million, while maintaining good profitability.

The revenues of the FBSerwis Group, which is a key asset in the services segment (the results of the service part also include the activities of companies from the RES area, Budimex Mobility and Budimex Parking Wrocław) amounted to PLN 675[1] million and were 1.4% higher compared to the corresponding period of the previous year. The FBSerwis Group generated an operating profit of PLN 69.2 million ( compared to PLN 60.1 million after three quarters of 2023), at the same time, it recorded an increase in profitability from 9.0% to 10.3%.

The RES area is constantly developing and focuses on expanding its portfolio. BxF Energia is in the process of implementing projects with a potential future capacity of over 1100 MW. More than half of this value is wind and hybrid (PV + wind) projects. The “Magnolia” project from September 2023. produces green energy, which we sell to one of the listed companies through a PPA (Power Purchase Agreement). We also purchased one ready-to-build project – “Azalia”, with 60 MW, and in May 2024 we started construction work. Our goal is to produce the first green kilowatt hour in the middle of next year.

Market outlook

We end the third quarter of 2024 with a record order book of over PLN 15 billion. What is particularly important to us is that most of the orders are relatively new projects, which were offered at current prices and contain indexation clauses. We expect that 2024 will be a record year for us in terms of contracting, hence we are also optimistic about the level of the order book at the end of the year. The current order book secures the work front for most of 2025. In addition, a significant number of orders are “design and build” contracts with completion dates of 2027-2028, which gives us the foundation of our business for the next 3-4 years.

The last few quarters in the Budimex Group have been a time of hard work and preparation of the organisation for growth in the coming years and the implementation of a record order book. We are adapting our implementation structures and at the same time strengthening the area of production support. We are also starting to build structures and prepare the organization to carry out orders for the construction of a nuclear power plant. We analyze and implement solutions on an ongoing basis to digitize and automate processes, also with the use of artificial intelligence, which partially helps to solve the issue of staff shortages. Our activities are aimed at preparing the entire organization for sustainable growth, taking into account the ambitious goals we have set in the ESG strategy for 2023-2026.

On the local market, we are constantly observing an aggressive fight for orders in the road, rail and cubature areas. In recently opened significant road and rail tenders, more than 10 bids are usually submitted, often with significant differences in price levels. On the one hand, this is a consequence of the lower supply of tenders, and we also see a tightening of the level of competition from foreign entities.

We implement our business assumptions on an ongoing basis, adapting to dynamically changing conditions. Recent years have shown that we need to carefully observe the environment and react appropriately in a way that will allow us to responsibly achieve our goals in the long term.

Responsibility

In the first half of the year, Budimex entered the WIG-20 index of the largest listed companies. We also received the Bulls and Bears award of the Parkiet stock exchange newspaper and the Forbes Diamond for our financial results. In June, Budimex was awarded the title of the Construction Brand of the Year based on the results of surveys conducted by over 2 thousand subcontractors in Poland. In September 2024, the company was also honored with the Company of the Year 2024 award during the XXXIII Economic Forum in Karpacz. Nine Budimex projects have also received the so-called. Construction Oscars, by the Polish Association of Construction Engineers and Technicians. The special prize was awarded for the modernisation of the railway junction “LOT C, section Most Wisła – Czechowice-Dziedzice – Zabrzeg” carried out by Budimex in 2023.

PKP CARGO S.A.. i Budimex S.A. signed a Letter of Intent on the employment of PKP CARGO S.A employees. New employment support program for PKP CARGO S.A. employees. includes employment of up to 100 people in professional groups in which Budimex S.A.. conducts recruitment.

In 2023, Budimex paid PLN 285 million in income tax on its operations. Thus, the company opened the list of companies from the construction sector and was among the top twenty largest individual payers in Poland.

In the last ten years, Budimex SA has paid a total of PLN 1 billion 432 million in CIT to the state budget. In 2023 alone, it was PLN 285 million – almost twice as much as in the previous settlement period. Since 2013, the company has been gradually improving its position in the ranking of companies operating in Poland. In the case of capital groups, it was a promotion from 67. out of 25. place, and individual payers – from deposit 64. to the top twenty.

[1] Revenue excluding reclassification of contractual penalties in accordance with IFRS 15: 689.8 million, y/y increase 24.3 million (3.6%)

Budimex Prezentacja Inwestorska 3q 24 Final V2