Contact us!

Contact information for the person responsible for the communication

Menu

About us

Offer

Electromobility

Foreign markets

We are reaching out further and further. We are making strategic investments outside Poland.

News

Contractors

Investor relations

ESG

Safety

This is our priority and our common good. We are committed to ensuring that our employees and partners, once the work is completed, return home safely.

Media

About everything we do.

On a regular basis.

Find in media:

29.07.2019

Market situation:

Market situation:

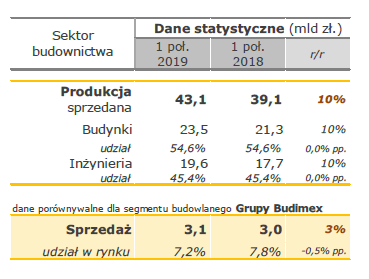

>> Construction and assembly production increased in the 1st half of the 2019 years. 2019 by 10% to PLN 43.1 billion. However, the monthly reading of market dynamics in June was much lower, which is a negative signal and may mean a slowdown in orders and an accumulation of work in subsequent periods

>> The difficult market situation translates into a significant deterioration in the financial condition of large entities that carry out the largest orders, largely based on subcontracting services

>> Some general contractors are beginning to signal problems with financial liquidity, the first bankruptcy petitions for large entities are appearing

>> In recent months, numerous infrastructure contracts have been terminated, m.in. sections of the S5, S61, S7, S3 expressways or a section of the A1 motorway

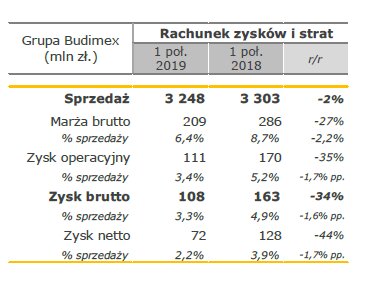

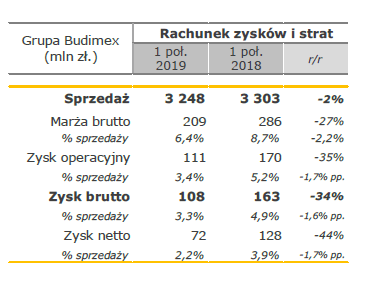

Budimex Group results:

>> The Group’s sales in H1 2019 was close to the level of H1. 2018 and reached the level of PLN 3.25 billion

>> The gross profit margin of the Budimex Group amounted to 3.3%

>> The construction segment remains under pressure from cost inflation, gross profit margin fell to 1.7% (compared to 3.6% in H1 2018)

>> The real estate development segment achieved a very good gross profit margin of 17.6%, thus improving the result from H1 2019. 2018, when the profitability amounted to 14.3%

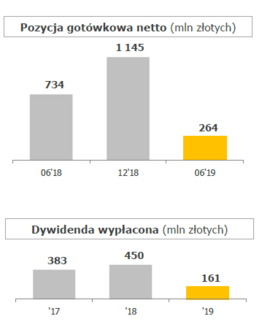

Cash position of the Budimex Group:

>> In the first half of 2019, we recorded a decrease in the net cash balance, typical for this period, to PLN 264 million

>> Net cash balance fell m.in. as a result of the payment of dividend in the amount of PLN 161 million and the seasonal increase in the involvement of working capital in the construction part

>> We are constantly observing delays on the part of investors in the process of accepting and invoicing the works performed

>> At the same time, the increasingly difficult liquidity situation in the industry requires the maintenance of the policy of financing subcontractors through early payments and the acceptance of more frequent invoicing of completed works

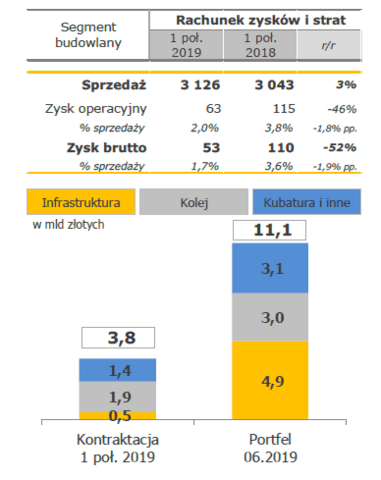

Results of the construction segment of the Budimex Group:

>> Sales of the construction segment increased by 3%, reaching a slightly lower dynamics than the industry – we focus on building a profitable order book

>> The gross profit margin of the construction part decreased to 1.7% compared to 3.6% in H1 2019. 2018

>> Due to external factors beyond the Company’s control, we expect an extended period of construction of the waste incineration plant in Vilnius and a deterioration of the financial result on this contract. We are conducting talks with the Ordering Party and the Consortium Member regarding further performance of the contract

>> The Budimex Group’s order book reached a record level of PLN 11.1 billion, mainly thanks to new orders in the railway segment

>> In July, we signed a contract for the continuation of works on the A1 motorway section and the construction of a gas pipeline for Gaz-System. Recently, we have also acquired new strategic clients such as JSW, Tauron and PGNiG

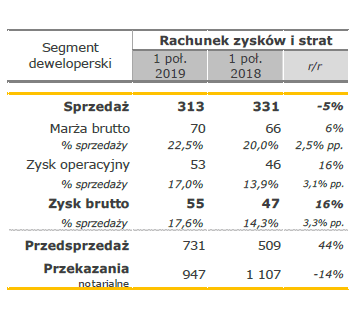

Results of the development segment of the Budimex Group:

>> Budimex Nieruchomości’s customers in the 1st half of the 2019, they signed 947 notarial deeds

>> The expansion of the offer in recent months has allowed us to achieve pre-sales of 731 apartments

>> The development segment’s revenues decreased by 5% and amounted to PLN 313 million, and gross profit to PLN 55 million with a high profitability of 17.6%

>> The current offer of Budimex Nieruchomości is almost 2 thousand apartments in 5 locations

The coming quarters through the eyes of the Budimex Group…

>> The situation of the Budimex Group is stable, and the record level of the order book allows for fully effective use of resources and secures the work front for the next few quarters

>>The average profitability of the portfolio is relatively good , but we are still feeling the effects of the completion of difficult contracts signed 2-3 years ago. The valorisation of contracts has been implemented to a limited extent in new projects of GDDKiA and PKP PLK , but there are no such solutions in local government procurement. As of today, we cannot assess how the new indexation mechanisms will work in practice

>> The market environment remains difficult, in particular in terms of the availability and retention of staff as well as the prices of materials and subcontractors. A deterioration in the liquidity situation in the industry is also visible

>> We have completed negotiations to acquire a 51% stake in FBSerwis. At the beginning of July, thetransaction was finalized and starting from this date, the Budimex Group will start consolidating the results of the FBSerwis Group. It is a strategic and long-term investment that diversifies the Budimex Group’s business

The Budimex Group…

>> It develops corporate social responsibility. Budimex won the 22nd edition of the “Benefactor of the Year” competition in the “Education – a large company” category for its involvement in the project of the first forest school “Puszczyk”. Recently, the 30th jubilee Parent Zone in Chorzów has also been opened

>> It tries to create the best possible working conditions for its employees. Once again, we were on the podium of the Most Attractive Employers Poland 2019 ranking in the “Engineering” category

Contact information for the person responsible for the communication

Budimex spokesperson